August 17, 1894, marked the first imposition of Federal income tax on corporations. Recognizing the significant benefits for both communities and the economy, the Tariff Act of 1894 included exemptions for nonprofits and charities. In the 130 years since, nonprofits have emerged as 10% of the private U.S. workforce. Among the 1.48 million 501(c)(3) organizations in the U.S. there is a wide variety of size, mission, and way of doing business. In this issue of Jani’s Journal, we blow up several common myths about nonprofits highlighted by Forbes and the National Council of Nonprofits.

Founded by Sherita Herring in 2017, National Nonprofit Day “educates, enlightens and empowers others to make a difference while acknowledging those in the trenches, impacting lives every day – the Change-Makers of the World!” (National Day Calendar).

Don’t keep Jani’s Journal to yourself! Subscribe for more insights and forward this newsletter to colleagues who might benefit. Let’s grow our community and enhance our collective impact.

Jani’s Jackpot!

If you only have time to read one article, Jani’s Jackpot promises the ultimate payout!

Myth #1: Nonprofits aren’t “real” businesses

🔗 Business Practices That Not-for-Profits Can’t Afford to Overlook 🔗

Myth Busted! “Not-for-profit status is a tax strategy, not a business plan…if there is not a financially viable organization, there is no mission delivery.”

This Journal of Accountancy article rightly highlights that nonprofits have different missions and goals than for-profits, “but both must have the right management team and business practices in place to function and grow.” Here are the top eight business practices nonprofits should implement for success:

Effective governance and board oversight through purposeful recruiting and training.

Strategic Planning focused on the next two to five years and incorporates every department (not just the mission-related programs or services).

Healthy financial and cash flow management practices.

Funded donor management that recognizes it takes money (to demonstrate the nonprofit’s value and thus ability) to raise money.

Use of technology to gather, analyze, and act upon mission-critical data.

Benchmarking against peer networks to uncover best practices and understand your place in the market.

Robust people development, leadership training, and succession planning.

Leverage marketing practices to optimize the customer’s experience, present information, and leverage media relationships.

Myth #2: Nonprofits can’t earn a profit

🔗 Nonprofit Cash Reserves: What to Do with Too Much Cash? 🔗

Myth Busted! The National Council of Nonprofits notes, “The key difference between nonprofits and for-profits is that a nonprofit organization cannot distribute its profits to any private individual.” Rather than paying shareholders a dividend as a for-profit corporation might, nonprofits reinvest their profits in the organization to grow their mission’s reach and impact. This article from the Nonprofit Accounting Academy examines the challenges and opportunities three nonprofits faced with “excess cash” and outlines several ways nonprofits can use their profits to achieve long-term sustainability. These include:

Operating Reserves invested in liquid assets (such as money market accounts) of at least 3-6 months of expenses that provide working capital during cash shortfalls.

Capital Reserves held in longer-term investments (such as stocks or bonds) that will fund future building repairs, equipment replacement, etc.

Quasi Endowment of board-directed funds can function like an endowment but with greater flexibility for reallocation based on the organization’s needs.

Myth #3: Low “overhead” indicates a well-run nonprofit

🔗 Nonprofit Overhead Costs: Breaking the Vicious Cycle of Misleading Reporting, Unrealistic Expectations, and Pressure to Conform 🔗

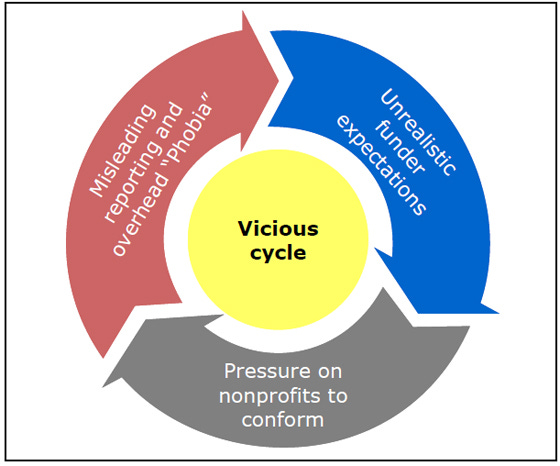

Myth Busted! This Bridgespan Group article highlights that “…some overhead is ‘good overhead’ - the kind that enables an organization to invest in the talent, systems, and training that create a foundation for healthy growth.” Bridgespan shares this vicious cycle:

Nonprofits can break the vicious cycle by advocating for realistic overhead expectations and demonstrating the impact of investments in infrastructure. This involves transparent communication with funders, highlighting the link between overhead investments supporting infrastructure & capacity and program outcomes, growth, innovation, & achieving mission-driven goals.

Myth #4: Nonprofits can’t lobby

🔗 Knowing the Rules for Nonprofit Lobbying 🔗

Myth Busted! Nonprofits can and should engage in lobbying activities as part of their larger advocacy efforts to advance their missions, as long as they understand and adhere to specific rules and guidelines. Key points to understand:

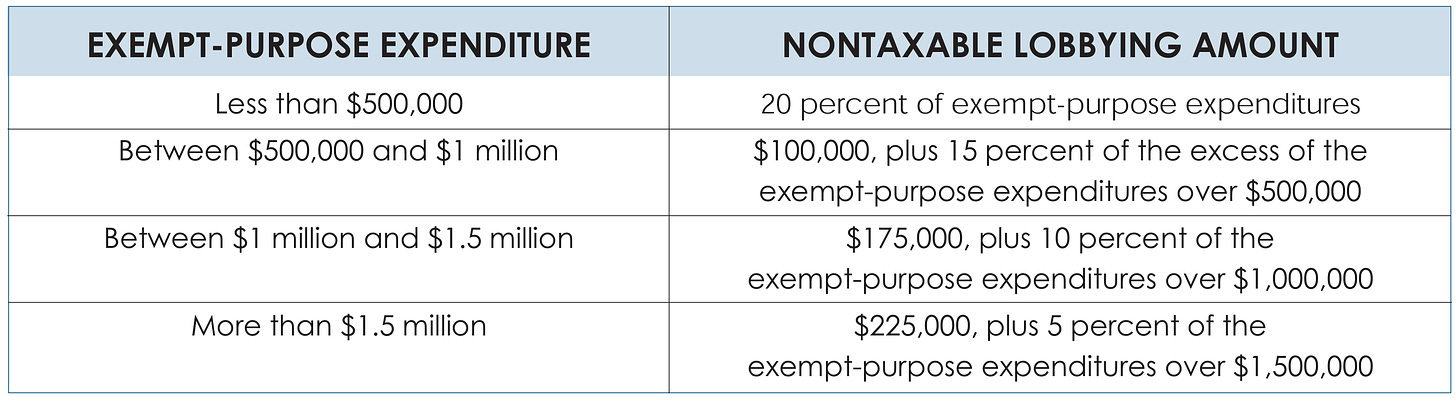

The IRS allows 501(c)(3) organizations to lobby, but it must not be a “substantial” part of their activities. Substantial expenditures are subject to 25% tax and excessive lobbying expenditures over a four-year period are at risk of losing nonprofit status. 501(h) establishes allowable nontaxable lobbying expenses based on the organization’s total exempt-purpose expenses for the tax year:

Lobbying is one of many types of advocacy that attempts to influence specific legislation at the local, state, or federal level. This includes contacting legislators and their staff to influence (propose, support, oppose) specific legislation and attempting to persuade the public to share your view on specific legislation. “Advocacy…focused on education about a specific issue on behalf of people your organization serves” is not lobbying.

Ready to incorporate lobbying activities into your advocacy efforts? Learn more about submitting Form 5768 to file a 501(h) election.

Myth #5: Nonprofits get most of their funding from donations

🔗 Ten Nonprofit Funding Models 🔗

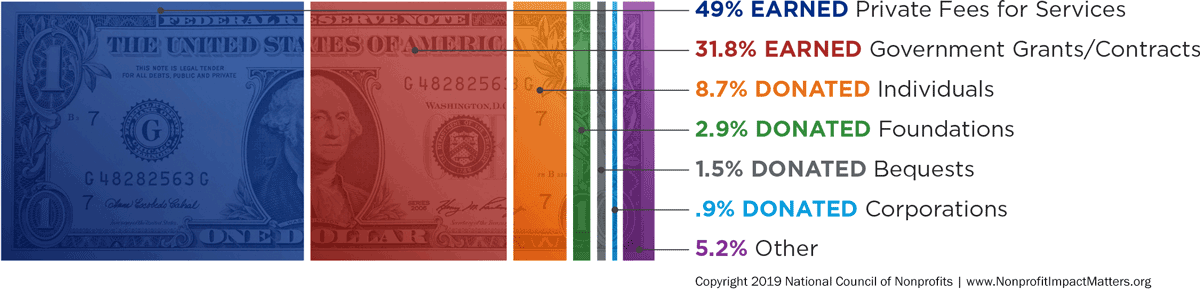

Myth Busted! The National Council of Nonprofits found over 80% of nonprofit funding is generated from earned revenue.

This Stanford Social Innovation Review article highlights the common misconception that nonprofits can't have distinct funding strategies, some of which involve earned revenue. By understanding these ten nonprofit funding models, organizations can emulate the clarity and strategic focus seen in the for-profit sector, allowing them to engage in succinct and effective conversations about long-term financial strategy:

Heartfelt Connector: Organizations like the Make-A-Wish Foundation resonate with a large audience and create structured opportunities for people to engage and donate. This model relies on emotionally charged causes that motivate widespread support.

Beneficiary Builder: Nonprofits such as hospitals and universities leverage past beneficiaries who donate due to the life-changing benefits they received. Donations supplement service fees and fund major projects like endowments.

Member Motivator: Groups like the National Wild Turkey Federation engage members who are passionate about a shared interest. Members contribute because they directly benefit from the organization's activities.

Big Bettor: Organizations like the Stanley Medical Research Institute secure substantial funding from a few major donors or foundations, often because the issue is personal to the donor and promises a significant impact with a large influx of money.

Public Provider: Nonprofits like the Success for All Foundation tap into government funds for services that align with pre-existing government programs, such as education or social services.

Policy Innovator: Organizations such as Youth Villages develop new approaches to social issues, convincing the government to fund their innovative methods by demonstrating greater effectiveness than traditional programs.

Beneficiary Broker: Nonprofits like the Metropolitan Boston Housing Partnership compete for government funds or vouchers, offering services that beneficiaries can choose, thus benefiting from government-backed competition.

Resource Recycler: Groups like AmeriCares collect in-kind donations from businesses, such as surplus goods, and distribute them to those in need, while also raising funds to cover operational costs.

Market Maker: Nonprofits such as the Trust for Public Land operate in areas where the market is willing to pay, but a nonprofit structure is more appropriate due to ethical or legal reasons, bridging a gap between donor and payer interests.

Local Nationalizer: Organizations like Big Brothers Big Sisters of America expand nationally by establishing local chapters that address community-specific needs, relying on local fundraising efforts for support.

Myth #6: Nonprofit staff should be paid minimally

🔗 Executive Compensation, Charities, and the Curse of Proximity 🔗

Myth Busted! This Harvard Business Review article describes how the harmful misconception that nonprofit staff should be minimally compensated prevents organizations from attracting and retaining top talent. By adopting a market-based approach to compensation, nonprofits can enhance their effectiveness and better serve their beneficiaries. The author rightly points to the disparities between “acceptable” high salaries in the arts and sports versus the highly scrutinized salaries in social service nonprofits to demonstrate what he calls the “curse of proximity.” Leaders working closest to human suffering are held to different standards due to sympathy overshadowing market logic.

“It doesn’t occur to us that the presence of a better, more highly paid professional may generate more money to the cause and to the people in need.”—Dan Pallotta

Low pay expectations that fail to recognize the value that well-compensated professionals bring to nonprofits hinder their efficiency and effectiveness, and ultimately compromise their mission.

Enjoyed this issue? Don’t keep it to yourself! Subscribe for more insights and forward this newsletter to colleagues who might benefit. Let’s grow our community and enhance our collective impact.

Know a colleague or friend who would like at least one of the articles in this edition of Jani’s Journal? Sharing IS Caring!